The terms Profit Margin and Markup are often used interchangeably to mean Gross Profit Margin, but they are not the same. A clear understanding and application of these concepts and calculations can provide the information you need to better impact your bottom line.

First of all, a very valuable calculation you’ll want to perform for understanding your business is Gross Profit, and then, the tool that you use to maintain gross profit, called Markup.

The gross profit on a product is:

Sales – Cost of Goods Sold = Gross Profit

To understand gross profit, it is important to know the difference between the expenses we call Cost of Goods Sold and the expenses we call Operational Costs.

Cost of Goods Sold are those expenses that are incurred as a direct result of producing the product. They tend to be variable costs such as:

- Materials used

- Labor directly involved in production

- Sales commissions

- Packaging

- Freight

- Utilities, or power costs, for production equipment and or facilities

- Depreciation expense on production equipment

- Machinery

Operational Costs are the more fixed costs such as:

- Rent

- Insurance

- Professional fees

- Office expenses such as supplies, utilities, a telephone for the office, etc.

- Salaries and wages of office staff, salespeople, officers and owners

- Payroll taxes and employee benefits

- Advertising, promotion and other sales expenses

- Auto expenses

While the gross profit is a dollar amount, the gross profit margin is expressed as a percentage (Gross Profit as a percent of Sales). It’s very important to track since this allows you to keep an eye on profitability trends. This is critical, because a business can get into financial trouble with an increasing gross profit that coincides with a decreasing gross profit margin.

The gross profit margin is computed as follows:

Gross Profit / Sales = Gross Profit Margin

There are two key ways for you to improve your gross margin. You can either increase your prices, or you can decrease the costs to produce your goods. Or both, if you can.

An increase in prices can cause sales to drop. If sales drop too far, you may not generate enough gross profit to cover operating expenses. Price increases require a very careful reading of inflationary rates, competitive factors, and basic supply and demand for the product you are producing.

The second method of increasing gross profit margin is to lower the variable costs to produce your product. This can be accomplished by decreasing material costs, or making the product more efficiently.

Volume discounts are a good way to reduce material costs. The more material you buy from a supplier, the more likely they are to offer you discounts.

Another way to reduce material costs is to find a less costly supplier. However, you might sacrifice quality if the goods purchased are not made as well.

Whether you are starting a manufacturing, wholesale, retail or service business, you should always be on the lookout for ways to deliver your product or service more efficiently.

And all the while, you also must balance efficiency and quality issues to ensure that they do not get out of balance.

Let’s look at the gross profit of Rapid Printing & Copy Company as an example of the computation of gross profit margin. In Year 1, the sales were $1 million and the gross profit was $250,000, resulting in a gross profit margin of 25 percent ($250,000/$1 million). In Year 2, sales were $1.5 million and the gross profit was $450,000, resulting in a gross profit margin of 30 percent ($450,000/$1.5 million).

It is apparent that Rapid Printing & Copy earned not only more gross profit dollars in Year 2, but also a higher gross profit margin. The company either raised prices, lowered variable material costs from suppliers or found a way to produce its print jobs more efficiently (which usually means fewer labor hours per product produced).

Rapid Printing & Copy did a better job in Year 2 of managing its markup on the products that they print.

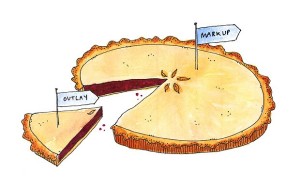

Business owners sometimes get confused when relating markup to gross profit margin. They are related in that both computations deal with the same variables. The difference is that gross profit margin is figured as a percentage of the selling price, while markup is figured as a percentage of the seller’s cost.

Markup is computed as follows:

(Selling Price – Cost to Produce) / Cost to Produce = Markup Percentage

Let’s compute the markup for Rapid Printing & Copy Company for Year 1:

($1 million – $750,000) / $750,000 = 33.3%

Now, let’s compute markup for Year 2:

($1.5 million – $1.05 million) / $1.05 million = 42.9%

While computing markup for an entire year for a business is very simple, using this valuable markup tool daily to work up price quotes is more complicated. However, it is even more vital.